How do you invest for retirement when you have a pension? Our Money Guy guidelines suggest investing 25% of your gross income for retirement, but it can be difficult to determine how much to save when you will have a pension in retirement. Then there’s the tricky question of asset allocation. Does a pension affect the other pieces of your investment portfolio?

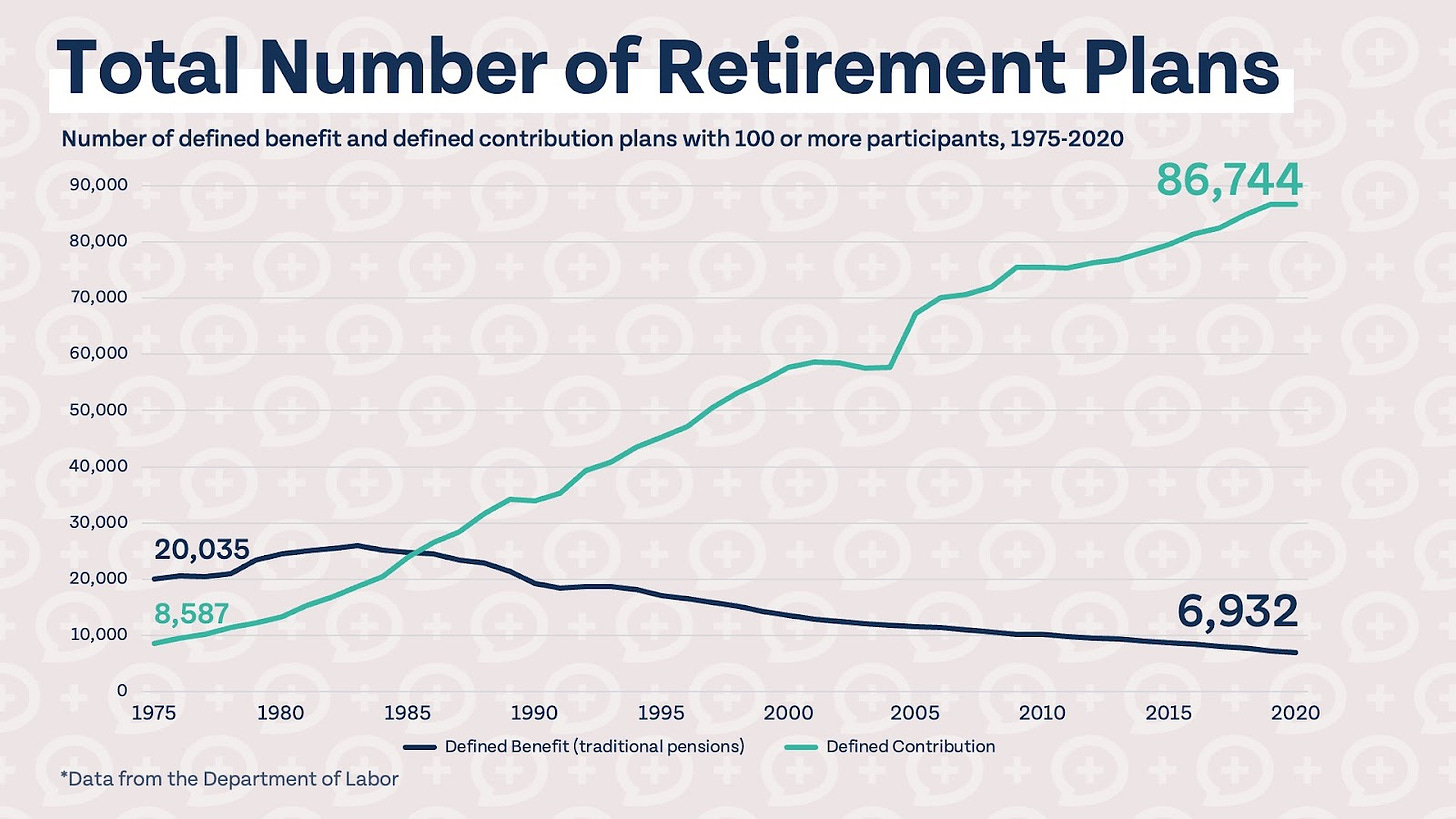

If you are under the age of 40, you might find it difficult to believe that pensions were previously the dominant retirement plan in America. They outnumbered defined contribution plans, like 401(k)s, by a ratio of over 2:1. Today, they are not nearly as popular, and there are less than 10,000 pension plans with 100 or more participants.

Still, pension plans aren’t going anywhere anytime soon. 21% of Americans have pension plans, and 83% of state and local government employees working full-time participate in a pension plan.

How much should I save if I have a pension?

One of the most difficult questions to answer is how much you should be investing for retirement outside of your pension plan. To start, if you don’t already know, find out how much both you and your employer are contributing to your pension. You may always include your own pension contributions in your savings rate, and can include employer contributions in your savings rate if you make under $100,000/single or $200,000/married.

Here’s an example: Jill is single and is required to contribute 5% of her annual pay to her pension, and her employer contributes another 5%. If Jill makes under $100,000, her savings rate would be 10%. If she makes over $100,000, her savings rate would be 5%.

That might give you an idea of what you should be aiming to save outside of your pension, but depending on your retirement goals, age, and how far ahead or behind the curve you are, you may need to save more or less. Our Know Your Number course can be a great tool for factoring a pension into your retirement number. I’ll show you how it works.

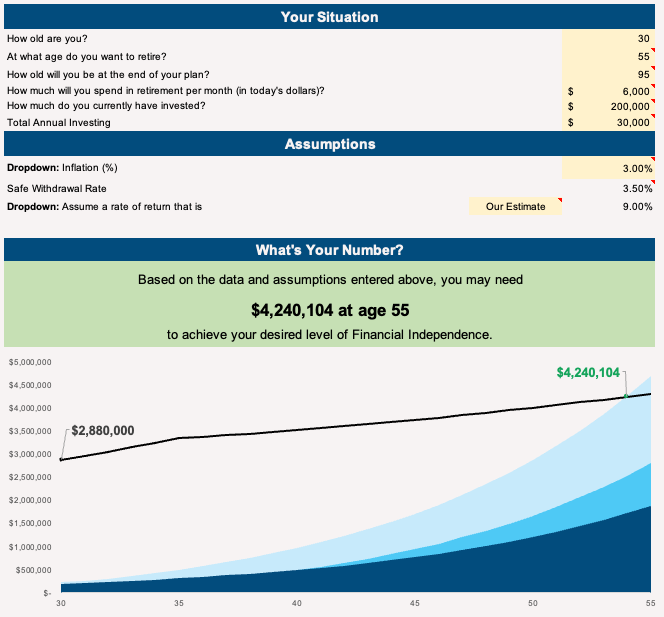

First, let’s look at someone without a pension. They are age 30 and want to retire at 55. They expect to spend $6,000 per month in retirement, using today’s dollars (pre-inflation adjustment), already have $200,000 invested, and invest $30,000 per year. They are currently on-track to meet their goal to retire at 55, based on their assumptions.

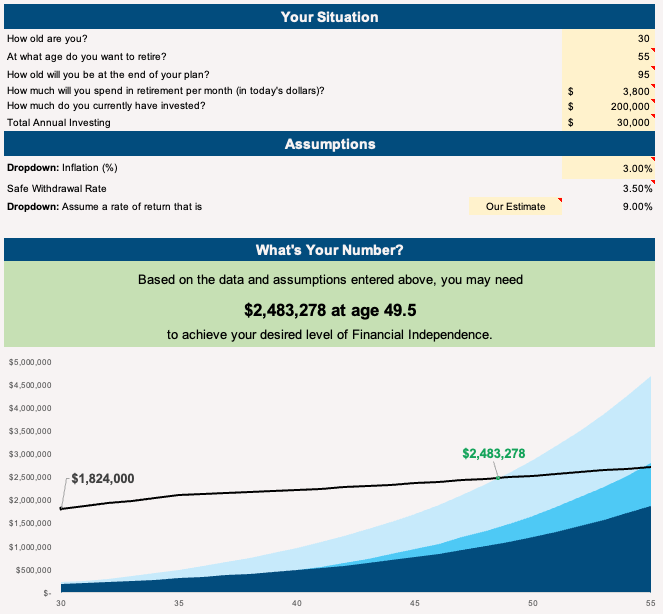

Now, what if they had a pension? Let’s assume they have a PBGC insured pension, and they will conservatively receive $2,200 per month starting at age 50 (which means they will more than likely receive more; it’s almost always better to be more conservative when it comes to estimating retirement needs). Here’s what their number looks like now with the same assumptions.

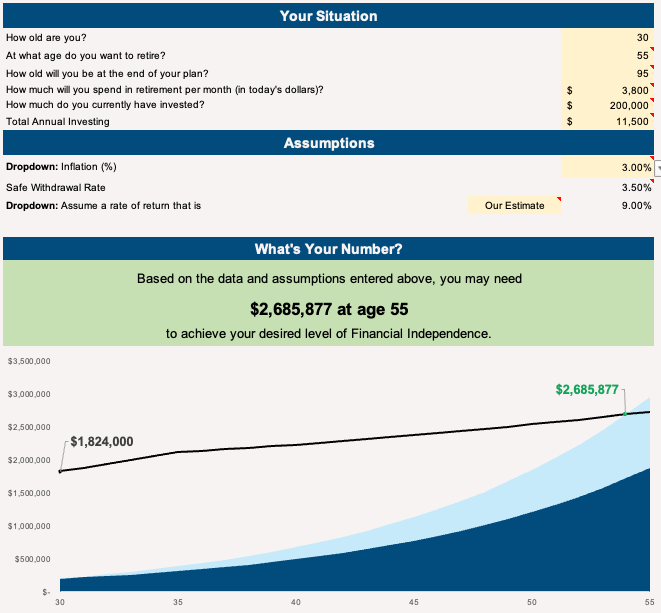

To account for the pension, expenses in retirement were reduced to $3,800. They are now able to retire just before age 50 based on the assumptions used. This means if they still would like to retire at age 55, they could save less per year or explore spending more in retirement (blossoming memories come to mind with travel and visiting family). Here’s what an updated calculation would look like.

To retire at age 55, with the assumptions chosen, they would need to invest just $11,500 annually outside of their pension plan. It’s incredible how such a “small” detail can significantly impact your retirement plan and how much you need to be investing. Investing 20% to 25% is a great place to start, but knowing your retirement number can help you know exactly how much you should be investing each month to be on-track to achieve your retirement goals.

What if I won’t get Social Security?

Some workers with pensions, including teachers in a handful of states, don’t pay Social Security taxes and won’t receive benefits unless they have enough credits from a different job. If you do have a pension and won’t be receiving Social Security benefits, consider including a much more conservative estimate of your pension in your retirement plan or not including it at all. It is not uncommon for teachers to transition to another school system or profession to build enough credits to qualify for Social Security after they meet the years of service requirement and their top three years of income are used in the pension calculation. A “best of all worlds” approach to optimize their retirement.

How does a pension affect my asset allocation?

A pension should not be viewed in isolation, but as part of your larger retirement plan and portfolio. Defined benefit pensions provide just that: a predetermined retirement benefit that doesn’t fluctuate with the stock market. Your pension can be viewed as a more conservative piece of your portfolio, which may allow you to take more risk with the rest of your portfolio.

Saving for retirement can seem more confusing when you have a pension plan, but it doesn’t have to be. Use our tools and resources to help you determine where your pension fits in your overall retirement portfolio and how it affects the other parts of your retirement plan. While you only have one retirement, our advisors have helped hundreds through the transition into retirement. If you would like to complete the Abundance Cycle to land the plane of your retirement journey, please do not hesitate to check out our “Work With Us” page at AboundWealth.com or MoneyGuy.com. Our ultimate goal is to help you live your best financial life so that your money works harder than you do with your back, brain, and hands.

Did you enjoy this article? Have any questions, comments, or suggestions for future articles? Let me know! And if you are a new subscriber, you can view the full archives online.

Thanks for subscribing to FYI by FTE! If you liked what you read, please consider forwarding it to a friend or family member. If you received this from someone else, you can subscribe now below.

Daniel out here with the content we NEED. I have been struggling with this for 2 years as a military employee. It’s wild to me how little content there is on pensions. I know they are rarer than ever, but a good 1/5 still have them and need to know how it affects them.

I took the know your number course and it made it clearer to me, but I’m glad to see it validate the approach I had. I simply came up with a monthly number of 100% my income and deducted my pension payments (40%) and then calculated my savings rate based on 60%.

Ultimately, I’m a mutant and still opted to do 22% into TSP and max IRAs but knowing I can slow down later or just bless people even more during retirement gives me peace. Or maybe I retire early. YOLO right lol 😎

Thank you for the article Daniel. I'm a federal employee and will receive a pension. I read Grumpus Maximus' book "The Golden Albatross," but still find pensions can be very complex. I have looked at several plan documents for myself and my wife of current and potential employees to measure the worth of their pension. When you add in trying assess how likely the fund will stay solvent then it adds in additional complexity.

I've found that mapping out my own retirement and wanting to have the option of retiring at 50 that I will most likely receive a deferred pension much later. I am also of the firm belief that if the money were invested in a defined contribution plan instead of the defined benefit then it would be worth much more. I initially thought I was getting a great deal with the pension, but as I have grown older I favor the defined contribution much more.

Again, thank you for the article.

Respectfully,

Brandon

Going to add in a link to my free blog if that is okay:

https://millionairelibrarian.com/